What Does Ym Mean in Beef Terms

A "Reasonably Probable" Excuse…

Great Ones, equally some of you may remember, I have a bit of a personal beefiness with drugmaker Biogen (Nasdaq: BIIB ).

I know. I know. You lot're not supposed to get emotional when trading or investing. It's the No. 1 rule, after all… Well, it's No. 2 behind "Don't Panic!" but the 2 are kinda one and the same.

Just when it comes to Biogen, I take a difficult time putting those feelings bated.

Y'all encounter, my grandfather died of Alzheimer's roughly 15 years ago. He was one of my best friends growing up. I nonetheless remember watching Indiana Jones, Humphrey Bogart and Fred Astaire movies with him on the weekends.

I'yard not exaggerating when I say that without my grandfather, at that place'd be no Slap-up Stuff.

Then Biogen's Alzheimer's drug Aduhelm had my interest from the moment the company appear it.

My interest is about more than just retribution for my grandfather or relief for the millions of Alzheimer'due south patients. Information technology'south near my family.

While Alzheimer's isn't technically hereditary, you do take a higher risk of developing it if a first-degree relative has it. It terrifies me that my children might have to go through what I went through with my granddaddy.

Nevertheless, when the FDA gave Aduhelm broad approving dorsum in June 2021, I was watching very, very closely. And I did not similar what I saw in the to the lowest degree.

In fact, this statement from FDA Drug Evaluation and Research head, Dr. Patrizia Cavazzoni, was more than disconcerting:

Treatment with Aduhelm was conspicuously shown in all trials to substantially reduce amyloid beta plaques. This reduction in plaques is reasonably probable to effect in clinical do good.

Reasonably likely. Yup. That's the phrase.

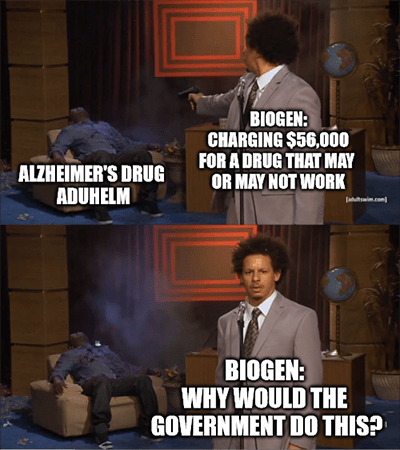

What's more than, Biogen initially sold a year'south handling of the drug for $56,000, more five times what analysts thought the drug should get for.

I'm not ashamed to say that I went on a footling unhinged bluster on the topic:

$56,000 for a drug that doesn't directly treat Alzheimer'southward.

$56,000 for a drug that doesn't deal with dementia.

$56,000 for a drug that is "reasonably probable to outcome in a clinical do good."

My granddad couldn't have afforded that "reasonable likelihood." I would argue that most Alzheimer's sufferers can't beget it either. That cost volition fall on Medicare, where the vast majority of Alzheimer's sufferers get their health care.

Turns out Medicare agreed with me and only approved Aduhelm for randomized clinical trials. Biogen then halved the toll of Aduhelm to try to brand more market place headway, merely information technology was all for naught.

Today, Great Ones, schadenfreude strikes again! Biogen is ending support for Aduhelm. The drug has officially bombed … commercially, at to the lowest degree. Not only that, but CEO Michel Vounatsos is stepping down over the debacle.

During its quarterly earnings written report this morn, Biogen said information technology is eliminating its commercial infrastructure for Aduhelm in an effort to save $1 billion. The visitor plans to reinvest that greenbacks in "strategic initiatives," "near-term operational priorities" and "increasing focus on R&D prioritization."

Man, that's a lot of corporate BS-speak. Basically, Biogen is saving money, putting money toward other drugs in its pipeline and researching new opportunities.

I'm betting one of those "strategic initiatives" will be a share buyback program, and you can quote me on that ane. I mean, BIIB stock is trading at its everyman betoken in about ix years, and the quickest way to shore up a stock price is with buybacks.

Personally, I'm a little flake distressing and disappointed by this decision. While Aduhelm wasn't the Alzheimer's "cure" many wished it would be, it could notwithstanding be an of import function of treatment for a devastating disease with very few approved drugs.

On the other manus, if Biogen hadn't been so greedy with the cost and ambitious with its marketing, Aduhelm might yet exist part of the Alzheimer's treatment equation. The company fix sky-high expectations and completely failed to live upward to them.

For investors, BIIB stock is down virtually 50% from its June 2021 highs. The stock is hovering near key psychological back up well-nigh $200.

Today's earnings report — which saw earnings miss expectations only revenue crush — was enough to provide a spark of promise for investors, specially with CEO Vounatsos stepping downwards and $1 billion in savings on the table.

Biogen will continue. BIIB stock will likely recover. Despite this debacle, Biogen is yet a market leader in the pharmaceuticals industry and is a worthwhile investment for pretty much whatsoever portfolio over the long term.

That said, information technology's going to be a long while before I invest in BIIB stock personally. And that'south all I've got to say most that.

Don't Purchase Any Bitcoin Until You Read This…

America'southward No. one crypto skilful, whose crypto trades take soared every bit high as 1,061% … 1,934% … and 18,325% — all in less than a year, says: "Bitcoin's best days are behind united states… And one 'Adjacent Gen Money' is going to take centre stage."

Get the full story here.

The Proficient: Vis Avis

You got a rental car. I want a ticket to anywhere … maybe we tin make a bargain on Avis (Nasdaq: CAR ) stock?

Anybody else is going to Avis for their rental cars this year, apparently. The company just dropped a banger of an earnings report that showed revenue rip-roaring 77% on the quarter.

Sales came in at $2.4 billion and handily topped estimates for $two.16 billion. Per-share earnings, on the other hand, reached a new record of $9.99 and walloped expectations for $3.45.

Avis' undercover? Co-ordinate to CEO Joe Ferraro: "We focused on diligent fleet direction and continued cost optimization to generate a new record starting time-quarter adjusted EBITDA."

Ah, took the words correct out of my mouth.

Short story short, Avis pivoted to see rising demand. That would be travel need, for all of you eagerly awaiting other travel-related stocks ready to study earnings.

Wall Street drove Car stock like it stole it, sending the shares up 8% afterwards the study dropped. Thing is, investors forgot to become the extra insurance, and CAR slammed into the clay today and totaled all its gains.

Amateurs.

You Got A Fast Motorcar … But Is It Mike Carr?

After an extensive xviii-month beta examination and over 12 years of back testing … Mike Carr has revealed a revolutionary, "first of its kind" investment organisation.

Investors can make I trade on ONE ticker symbol ONCE a week in and out, and they can target gains of x% … fifty% … fifty-fifty 100% or more than every fourth dimension. Click hither to see our most powerful new investment system, revealed.

The Bad: Guess It Wasn't That Paramount

I'm burnin', I'thou burnin', I'm churnin' for … advert sales. — Paramount+ execs, probably.

Seriously, I gotta know: Do any of you subscribe to Paramount's (Nasdaq: PARA ) namesake streaming service? And I'chiliad not talking near sharing passwords either…

Well-nigh 6.3 million people signed upward for Paramount+ this past quarter, according to the visitor's latest study. At a time when Netflix (Nasdaq: NFLX ) is but losing subs, this is no small peanuts for Paramount.

That said, let's not forget that these subscriber adds still bring Paramount+ to "merely" 62 one thousand thousand subs. Yet while Paramount'south adds were decent … ads, on the other hand, were not. Weak ad sales left Paramount missing revenue estimates past a whole 1%. The nerve!

So what'south the rub?

It's this key bit of info right hither: "Wall Street has raised concerns over the long-term viability of streaming equally the pandemic blast fades." Sounds awfully familiar to what we said after Netflix's written report, doesn't it?

Information technology'southward not that streaming is expressionless … but we have entered a new phase. Growth is gone and not only for Netflix.

We've hit basically max penetration in the U.South. of everyone who's going to stream. We're now in the "churn" phase … just like erstwhile cable companies and cell service providers. Paramount got started on streaming style too late and now it'southward stuck without a growth phase like Netflix or Disney+ had.

This is what churn looks like. And acquiring subscribers during the churn phase is a lot more than expensive. Only ask Verizon and T-Mobile … or the now-dead Sprint.

The Ugly: We Don't Need No Chegg-ucation

Earlier we dig into today's bodily Quote of the Week, indulge yourself in what may be the biggest understatement of the year. So far…

We entered the twelvemonth with momentum, yet this trend has not connected at the level nosotros expected. — Chegg CEO Dan Rosensweig

I … I think Rosensweig speaks for everyone in saying this. Similar … all of humanity.

If you don't know about education services platform Chegg (NYSE: CHGG ), it might be because hardly anyone'south using Chegg'south services anymore, judging by the company'due south latest report.

Now, Chegg's written report wasn't bad bad per se — earnings beat out while revenue missed — but Chegg's forward outlook was enough to ruin any possible positivity.

Instead of the $260 million to $270 million profit Chegg previously predicted for 2022, the visitor now simply expects to brand $220 million to $235 million. Oof.

All the usual suspects filled Chegg's report. Aggrandizement is ruining everything! The economy is in shambles! Nobody's enrolling in schools or our platform! It'due south … umm … all of the above, actually.

But the Chegg CEO also pointed toward another alibi — er, reason — for its lowered profit outlook, and it's a doozy:

Students continue to have fewer classes and those they do have are oft less rigorous, with fewer or more than limited assignments. With higher wages and increased price of living, more than people are shifting their priorities towards earning over learning, resulting in a lower course load, or delaying enrollment in schoolhouse at this time.

You catch that?

Instead of strapping themselves to hundreds of thousands of dollars in debt all while wages stay mostly stagnant, more than people are but not feeling that whole education matter right at present. "Shifting their priorities" is a much nicer way of saying "I need to work now instead of learn."

Are yous surprised? I'm non.

Remember, I didn't say information technology…

If the deal goes through we make some money, and if it doesn't go through who knows.

— Warren Buffett

Want to know how you can tell the Activision (Nasdaq: ATVI ) and Microsoft (Nasdaq: MSFT ) deal is gonna go through? Buffett'southward betting on information technology.

Ol' Warren B. just dropped $v.half-dozen billion for a 9.5% stake in Activision as the globe awaits word from antitrust regulators. Because we oasis't heard annihilation confronting the tie-up thus far … Buffett took it upon himself to dive in.

Then let's dive in as well.

While Buffett's quote might seem like a YOLO bet you lot'd find on, well, certain Reddit subforums … buying into ATVI right now isn't as risky as you might call back. If anything, it's the safest YOLO ever.

Consider the following: If Microsoft buys Activision, boom, done bargain. Buffett makes money. Plus, there's not a whole lot of antitrust chatter out in that location, so I would exist surprised to encounter this blocked.

At present, if Microsoft doesn't terminate up buying Activision, Buffett still owns stock in one of the biggest video game makers on the planet … and video games aren't going anywhere. Gaming might run into a dip as people "affect grass" more than later the pandemic, but they'll be back … especially for Activision.

I mean, it could be worse — Buffett could've bought Chegg. Ugh.

I guess that'south not what he meant by circumventing inflation by investing in yourself, your skills and your education, is it? Just be a md, a lawyer or a professional investor who makes billion-dollar bets on video game companies. Information technology's simple, really.

So video games stay, Chegg-ucation goes? Sounds about right.

Hey, you said it…

What do yous think about Buffett's big bets, Great Ones? Will Microsoft's gamemaking bargain go through? And what's the deal with Biogen trying to forget nearly its Alzheimer's drug plans?

Let me know in the inbox. One time you lot've shared your thoughts, here's where else yous can notice united states of america beyond the interwebs:

Greatness:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!

Regards,

Joseph Hargett

Editor, Great Stuff

ayalathencestraes.blogspot.com

Source: https://banyanhill.com/aduhelms-deep-lord-rental-cars-paramounts-doom/

Posting Komentar untuk "What Does Ym Mean in Beef Terms"